unrealized capital gains tax bill

A newly proposed annual tax on unrealized investment gains has been floated as a way to pay for the new 35T infrastructure bill. President Bidens 2 trillion spending package continues to stall as senior Democrats are hoping to finalize a proposal on a new annual tax on billionaires unrealized capital gains Democratic.

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

According to The Wall Street Journal.

. Unrealized gains are not generally taxed. How Billionaires Like Musk Could Use Options to Cover the Bill. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408.

You dont incur a tax liability until you sell your investment and realize the gain. Or if the billionaire used the option of treating 1 billion of stock as non. This article is in your queue.

Democrats are homing in on unrealized capital gains raises as a way to help fund their social spending bill. Many have held their stack for years through steep price declines only to see the price ratchet up to new highs every year. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by democrats as another step to make the rich pay for the uncontrolled spending by the federal government.

WASHINGTONA new annual tax on billionaires unrealized capital gains is. These are also known as paper profits or losses as well as running profits or losses. Currently the tax code stipulates that unrealized capital gains are not taxable income.

Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. The main reason you need to understand how unrealized gains work is to know how it will impact your tax bill. Much of billionaires capital gains right now escape.

President Biden Unveils Unrealized Capital Gains Tax for Billionaires Posted on 10252021 As US. Oct 25 2021 US. President Joe Biden and congressional Democrats had considered taxes on unrealized capital gains earlier in negotiations around a social and climate bill.

The 75 billion per year estimate is a massive. A tax on an increase on unrealized and of course possibly ephemeral gains is only on the most stretched of interpretations a tax on. Gains and losses are realized at the point of sale.

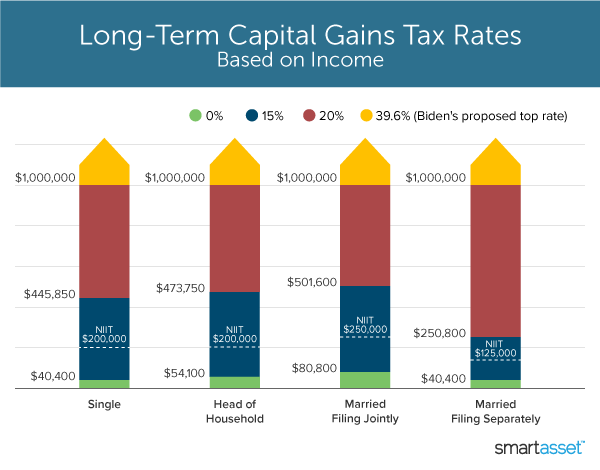

Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. The tax targets unrealized capital gains which are oxymorons that exist only in the minds of tax law enthusiasts. An unrealized gain can also turn into an unrealized loss if the value of your investment changes before its sold.

If an unrealized capital gains tax is enacted it could have major ramifications for the economy and create a dangerous precedent. What is an unrealized capital gains tax. Unrealized Capital Gains are Not Part of Income Just imagine that you paid 1000 to purchase a stock this year and on December 31 2021 it is valued as 2000 based on then current stock prices.

If it passes what is the point in investing in the. November 29 2021 by Brian A. It looks like this post is about taxes.

Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is. This policy allowed the richest Americans to get richer by minimizing their tax obligations. Jason katz brown november 23 2021.

Unrealized Capital Gains Tax Capital Gains Tax Rate 2022 It is widely believed that capital gains are the result of earnings made through the sale an asset such as stocks real estate stock or a company and that these profits constitute taxable income. This means that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset. The bill apparently only will affect the most wealthy people.

Taxing billionaires unrealized capital gains as in sen. The proposals would have affected the. So an unrealized gain or loss is when the value of an asset has increased or decreased but you havent actually sold it yet.

0000 0138. However not all realized gains are taxed at the same rate. The proposal would allow 1 billion of stock in a single corporation to be treated as non-tradable in an attempt to provide protections for business founders At the current top capital gains tax rate of 238 percent the tax bill on a 3 billion gain would be 714 million spread over five years.

Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. Speedy fluctuations in the stock market can do sometimes that. I tend to think once you go down the path it will only grow until more and more people are getting taxed for unrealized gains.

Unrealized Capital Gains Tax. Taxes Taxes Taxes It has already been a long year of new taxes tax hikes and even more tax proposals. President Biden Unveils Unrealized Capital Gains Tax for Billionaires Posted on 10252021 As US.

You buy 05 Bitcoin for 30000. Under this rule you will pay taxes on unrealized gains on liquid assets. Nov 11 2021.

The plan will be included in the Democrats US 2 trillion reconciliation bill. Bitcoin HODLers live by the words of the 1987 Rick Astley hit song Never Gonna Give You Up. A capital gain is the profit you make when you sell an investment asset for.

How might it change the best investment strategies. Under the current tax code unrealized capital gains are not considered income by the IRS so theyre not taxed. Global asks Democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis.

A proposed House Ways and Means bill suggests raising capital gains tax rates to a maximum of 28 percent still lower than the top rate for income tax.

What S In Biden S Capital Gains Tax Plan Smartasset

Bitcoin Gains Can Become Tax Free Cryptocurrency Investing In Cryptocurrency Bitcoin

Urban Catalyst S Guide To Short Term Capital Gains Tax

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

12 Ways To Beat Capital Gains Tax In The Age Of Trump

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Will The Unrealized Capital Gains Tax Proposal Apply To Most Investors The Motley Fool